Litecoin (LTC) has failed to capitalize on its recent bullish momentum following an unsuccessful attempt to break through its infliction point and major CPM key level at $100.68

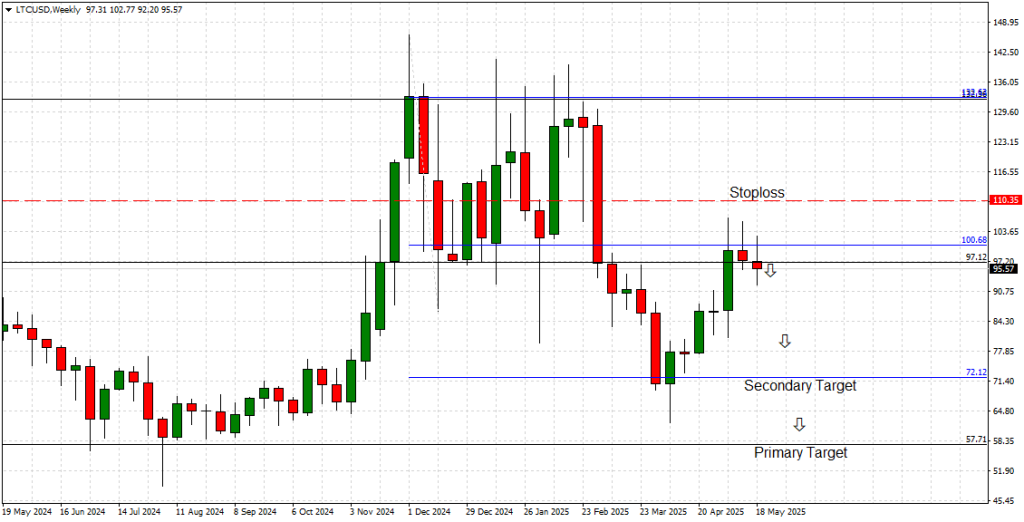

Litecoin (LTC) has failed to capitalize on its recent bullish momentum following an unsuccessful attempt to break through its infliction point and major CPM key level at $100.68. While the market briefly pierced this critical resistance, the move proved to be a bullish trap, lacking confirmation on higher timeframes such as the Weekly and Monthly sessions. This rejection now sets up a compelling case for a deeper corrective move as macroeconomic pressure continues to build.

The intensifying global tariff war situation has cast a shadow over risk assets, triggering capital rotation out of speculative markets and back into defensive positions. Crypto markets — including Litecoin — are increasingly vulnerable, with LTC trading back below $100.68 and facing mounting downside risks.

Breakout Levels and Technical Outlook

The Weekly chart (see attached) captures the rejection cleanly. Litecoin’s price action temporarily breached $100.68 but quickly reversed, leaving behind rejection wicks and confirming the level as a firm ceiling. The absence of a high-timeframe close above $100.68 leaves this level untouched as the sole Major Resistance on the board.

Key Levels to Watch:

-

Major CPM Key Level & Resistance: $100.68

-

Immediate Support: $97.12

-

Secondary Bearish Target: $72.12

-

Primary Bearish Target: $57.71

-

Protective Stoploss: $110.35

A breakdown beneath $97.12 would likely accelerate bearish momentum, exposing $72.12 as the next significant target. If selling pressure intensifies, the move could extend toward the Primary Bearish Target at $57.71.

Any invalidation of this bearish scenario would require a sustained Weekly or Monthly close above $100.68, with a protective stop positioned at $110.35.

Price Action and Market Momentum

The rejection at $100.68 has shifted momentum sharply lower. Technical indicators reflect declining buyer interest, with RSI and MACD on the Daily and Weekly charts turning bearish. Price action is now producing lower highs beneath the critical $100.68 ceiling, with downside pressure evident.

A clean breakdown through $97.12 would confirm a fresh bearish phase, putting the secondary and primary downside targets in direct play. Market volatility remains high, and with sellers gaining traction, the path of least resistance is shifting decisively lower.

Technology and Market Fundamentals

From a fundamentals perspective, Litecoin’s core technology remains unchanged in recent weeks. While long-term initiatives such as MimbleWimble Extension Blocks (MWEB) and continued payment gateway adoption offer future value potential, short-term sentiment is dominated by macroeconomic headwinds.

The worsening tariff war tensions have heightened market volatility, prompting investors to reduce exposure to risk assets — including cryptocurrencies. This macro backdrop compounds the technical weakness at play, increasing the likelihood of an extended bearish cycle for Litecoin.

Conclusion: Bearish Outlook Confirmed

In summary, Litecoin’s failed breakout above $100.68 signals a pivotal market rejection and confirms the recent move as a bullish trap. With downside risks mounting, immediate support at $97.12 is now the key level to watch. A break below this threshold would likely open the door to $72.12, with a possible extension toward $57.71 if bearish momentum accelerates. Unless bulls reclaim $100.68 with authority on the Weekly or Monthly close, the bearish bias remains firmly in place.

Shortcut