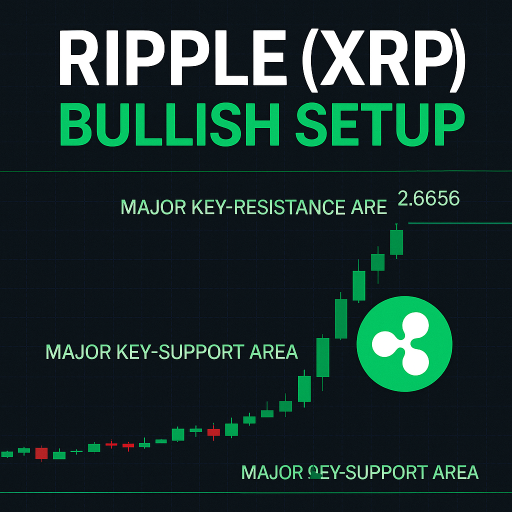

Ripple (XRP) has been on the backfoot in recent weeks, caught up in the broader market correction driven by escalating tariff wars and risk-off sentiment across digital assets.

However, the technical structure now suggests that this correction may have run its course, with price action successfully defending a major key support level at $2.1330.

A large-scale upside reversal is now cocking up, with price action primed for a fresh bullish cycle targeting our original upside objective at $2.6656.

Key Breakout Levels to Watch

Weekly & Daily Chart:

-

Intermediate Key Support: $2.1330 — The price has tested and held this pivotal level, marking the exhaustion point of the corrective leg.

-

Inflection Point /Major Key Support: $2.0588 — A break and close below this major horizontal support would force us to re-analyze and re-position our overview of the technical situation.

-

Major Key Resistance & Primary Bull Target: $2.6656 — The next significant upside objective, representing a critical structural high from earlier in the year and a technical magnet for bullish continuation.

Price Action Momentum

After an extended corrective move off highs near $2.66, XRP printed a clean test of $2.1330, coinciding with a visible slowing of bearish momentum and early bullish tail structures on daily and 4H timeframes.

Key technical reads:

-

Bullish reversal patterns developing at $2.1330 on daily and 4H charts.

-

Momentum oscillators showing bullish divergence against price at the support.

-

Expecting a bullish breakout sequence to ignite above $2.255 — confirming the reversal structure and clearing the path toward $2.6656.

Volatility is likely to expand sharply on a confirmed break above $2.255 as liquidity builds for a move toward $2.6656.

Market Narrative & Ecosystem Developments

While macro uncertainty around tariff wars sparked the latest crypto-wide retracement, Ripple’s on-chain and ecosystem fundamentals remain resilient:

-

Ripple’s XRPL smart contract upgrade introduced native programmability, modernizing the network for institutional-grade financial products.

-

The SEC formally dropping its legal battle against Ripple has restored institutional confidence in XRP as a regulated, tradable digital asset.

-

Ripple’s new stablecoin RLUSD is gaining market traction as a compliant, enterprise-grade settlement instrument.

These factors continue to underpin medium-term bullish sentiment for XRP.

Final Thoughts

With the market correction appearing exhausted at $2.1330, Ripple is now technically primed for a decisive upside reversal. A break above $2.2550 would act as the trigger for a momentum-driven rally, with bulls targeting the major resistance at $2.6656 as the next key waypoint.

Short-term pullbacks into the $2.20–$2.25 zone would offer attractive risk-reward long opportunities, with stops logically placed below $2.0588.

This setup offers a compelling technical and narrative-driven opportunity heading into the new week.

Shortcut