Neckline Trading

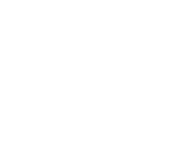

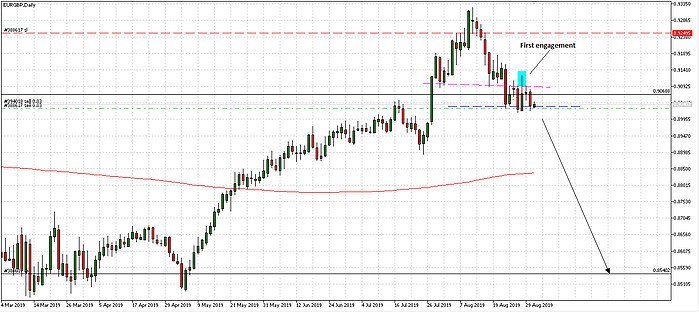

There are very few trading setups that excites us as much as the Neckline – Double Top setup. Straight from our most important list of Trend Reversal Patterns, Neckline trading technique is a derivative of the Head and Shoulders pattern. The setup itself is not too abundant and will only appear every now and then. However, when it does appear, it’s a gold mine. It carries one of the highest success rate scores amongst all the advanced setups that we normally apply in our day to day trading.

After countless of neckline trading events, we can estimate the success rate of this trading technique at around 85%. We assume that the main reason for this high success rate score is the powerful relationship between the neckline of an established Head and Shoulders pattern and a simple Double Top Pattern that interacts with that neckline from below.

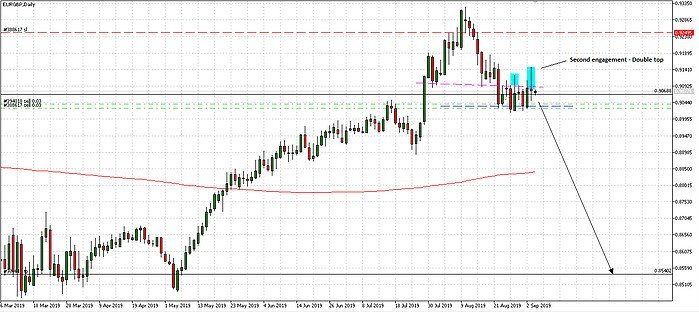

Effectively speaking, on the second touch, the neckline is being confirmed by price action which by now, is officially a solid-strong resistance level, and its probably going to hold its ground. This means that with unusually high probability level, price is going to bounce off that resisting neckline into a full-fledged downside move, continuing the natural flow of the original Head and Shoulders breakout.

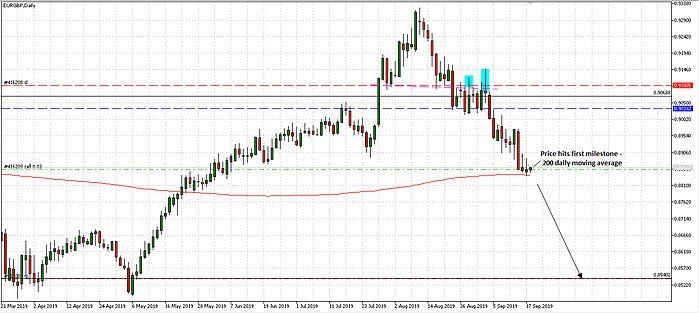

The second bounce off the neckline, in this Neckline trading case study, completes the setup and triggers our full commitment to push more trades and increase our short position. Even though we have a long way to go till our primary price target at 0.8540, we are going to utilize the relatively close by 200 Daily M.A as a secondary price target for partial profit taking.

Roy Levine,

Head of Trading

If you want to know more about trading techniques check out Bulletproof Traders YouTube channel. To benefit the full range of our exclusive trading service, become a member.